Open Review of Management, Banking and Finance

«They say things are happening at the border, but nobody knows which border» (Mark Strand)

Cryptocurrency (and Bitcoin), a new challenge for the regulator

by Mirella Pellegrini and Francesco Di Perna

Abstract: The evolution of the economic processes is reflected on the way the currency work. The recent development of new methods of payment based on the computer systems – and, in particular, the electronic-based systems used to register the debit\credit position, the operationalization of the market – have elicited the growth of the phenomenon of cryptocurrency, and bitcoin is nowadays the most common. There is still no precise definition of cryptocurrency at the moment, due to the complexity in matching the cryptocurrency with the proper related case in issue. That said, it is crucial as in the face of a growing interest in bitcoins, the predisposition of an adequate control mechanism, still missing, is assuming a more and more importance; and in such a critical context, this lack treats the potential traders in this new segment. The awareness of the effective consistency and diffusion of the phenomenon should encourage the authorities in taking actions against the potential risks, especially for those inexperienced operators that are not able to identify and evaluate them, attracted by the promise of high profits with low investments. One of the most critical aspect in subiecta materia is the fiscal treatment of those bitcoin operations with particular regard to money laundering and terrorism financing. The growing phenomenon of crypto currencies – in addition to introduce potential danger (with evident damages for those who use them improperly) – emphasizes the need to move forward new forms of regulation of such complex matter, so that it can be redefined under the competence of the public authority.

Summary: 1. Introduction. – 2. Financial supervision and technological phenomena. – 3. Cryptocurrency and bitcoin: main features and functioning. – 4. Segue: The related risks. – 5. Issues and expectations: anti-money laundering and fiscal treatment. – 6. Conclusions.

1. The evolution of the economic processes is reflected on the way the currency works. It follows that the currency – due to its initial role as medium of exchange, and store and measure of value – nowadays has become a crucial point for the definition of a new method of payment[1]. An extension of the traditional functions of the currency leads to the so-called monetary sovereignty, defined as the power of the state to exercise the power over the economic and financial equilibrium of a country[2].

The recent development of new methods of payment based on the computer systems – and, in particular, the electronic-based systems used to register the debit\credit position, the operationalization of the market – have elicited the growth of the phenomenon of cryptocurrency, and bitcoin is nowadays the most common. The abovementioned phenomenon, as far as comparable to the legal criteria to define a currency – this aspect will be discussed in the next paragraph – it cannot be defined as a substitute of the currency, neither it seems to be similar to the ordinary methods of payment diffused in the market.

The interest that cryptocurrency is increasingly attracting– and so far, the appeal that it arouses among the population – is generated mostly by the promise of possible financial returns in an economic context of low interest rates. It is clear that their nature and incidence on the market is significant. Furthermore, because the currency is acquiring a role more and more far from the original role that it had, we need to be sure that the cryptocurrency can be qualified as a financial instrument and that it needs a different legal framework that better reflects their real essence.

This analysis must take into account the typical features of these currencies (anonymity of transactions, lack of ties with the so-called fundamental, absence of a central bank, lack of intermediaries to validate and record the transactions, the overall riskiness due to missing regulation). Such analysis must highlight the general lack of any economic and legal prerequisites that enable to equalise the bitcoin to the legal currency[3]. On the other hand, it is crucial to understand the potential implications of a bad use of these instruments, for example the illegal purposes (e.g. money-laundering) to cover the payments related to criminal activities (thanks to the anonymity of the transactions)[4].

Moreover, it must be analysed the information requirements provided from the supervisory authorities[5]. The latter – although not allowed to take part in it (and so, unable to regulate the bitcoins in any ways) – have elaborated a series of guidelines (in a soft law regime) [6] finalized to show the possible risks for the traders in operating in such a deregulated context and, lacking the necessary compliance with prudential and risk aversion criteria[7].

2. To better understand the following discussion, some introductory remarks about the boundaries of the financial and banking supervision regarding the technological aspect are required.

The recent economic events show a growing number of technological platforms over the intermediation process (i.e. Directive EU 2015/2366, cd. PSD2, on payment services); so we must evaluate whether the cryptocurrencies can be treated as other instruments regulated in the legal system, with particular focus on bitcoins, that can easily turn into a dangerous speculation bubble[8] (infra par 4).

The phenomenon under investigation is furthermore different from the standard electronic payment systems regulated by the legal system[9]. It follows that such electronic payments (recurring in the recent market operational routines), in contrast to the cryptocurrencies, can be officially assimilated to the legal currency.

As a matter of fact, the evaluation of the cryptocurrencies phenomenon is not possible – together with the identification of the technical profile – without the awareness that a potential diffusion can lead to significant consequences on the production and consumption level, with subsequent impact on the social wealth and government intervention.

On the light of that, an uncontrolled development of cryptocurrencies seems to predict a “digital capitalism”, though hiding the possible negative consequences that can materialize if that reality would become true. In particular, there might be a possible imbalance in the market and consequent uncertainty about the stability of the rates of exchange if the tie between the currency and the sovereign authority, the central banking system indeed, would be suppressed[10].

It is known that the statist view of the currency is based on its standard of deferred payment, meaning that currency is able to settle any debts, if it is used as legal currency. This specific function cannot be attributed to the bitcoins, unless there is an agreement between the parties involved which acknowledge the bitcoins as an instrument to fulfil the obligations.

As the literature has emphasized, there is still no State that has adopted cryptocurrencies as legal currency[11]; for this reason, their standard of deferred payment is based only on the functional characteristic of the currency, and they (especially bitcoins) are only “imperfectly” able to fulfil that function[12].

In that context, relying on a system based on a technical formula (where, in addition, the value expressed by cryptocurrency is volatile) means abandoning the idea that the Law is able to legalize the payments through the regulation of the currency power. There can be little doubt that the phenomenon under investigation is a consequence of the financial crisis of 2007[13]. The crisis has determined an overall mistrust towards the financial system, a mistrust followed by a growing disappointment towards the government institutions and, in general, towards the State powers (first of all the monetary one).

It follows that the legislator is facing a scenario that requires a new regulation that enables a technological system platform related to an official regulated currency, and that ensures negotiations protected from the uncertainty of the cryptocurrencies. In other terms, we assert that the major duty for legislator is to regulate the fluctuating possibility to make profit from the bitcoins. In addition, we believe it is crucial also to control the potential use of bitcoins for money laundering, possible where there is no proper regulation[14].

Recently the European Commission, worried about the stability of the system, has included in its amendment proposal of the IV Anti Monetary Laundering Directive (“4AMLD”) (COM/2016/450/Final)[15], two new categories of legal entities to which the Directive is applicable: A) exchange platforms of virtual currencies, B) custodian wallet providers (from 6 and 7; art. 1, comma 9, lett. c). Such amendment, contained into the 5AMLD, indicates how the lack of a proper differentiation between legal currencies and virtual currencies can be problematic; only the latter in fact, can be subjected to the Financial Intelligence Units (EU FIU Platform) and, in general, to a reduction of the risks resulted by such innovative payment methods.

3. Nowadays there is still no precise definition of cryptocurrency[16], due to the complexity to find a proper legal shape for the phenomenon[17]. With no doubts the virtual currency expresses the digitalization of the various legal and economic areas. As a special case, it has legal value only between private parties and cannot be defined as currency (a fortiori legal)[18]. In addition, we must not forget the lack of legal protection for those who receive cryptocurrencies as a payment for a transaction. In other terms, the art. 693 p.c.[19] is not applicable, since the acceptance of bitcoins as currency is left to the discretion of the parties involved, and therefore, not mandatory[20].

It seems clear that the genesis of bitcoins can be referred to the combined effect of the growing technology and the evolution of cryptography, combination that has enabled to execute anonymous transactions, without a (supervised) mandatory intermediary and with less costs. Furthermore, we should say that cryptocurrencies help to resolve some key problems created by the globalization; we refer in particular to the shadow banking system[21], the Individual Saving Plans etc., financial instruments that although not illegal, are out of the regulation for the investor protection[22].

To better understand the extent of the above phenomenon, we need to analyse the underlying technology (blockchain), a digital software platform for cryptocurrency transactions that lacks of a decentralized, public ledger authority to guarantee the transactions.

To be noticed also the fact that nowadays bitcoins represent the most common form of cryptocurrency. The latter represent an alternative monetary system, extremely diffused at global level[23].

In such context, we must acknowledge the significant innovative elements of the blockchain technology, especially the indelible tracking of the data, which cannot be changed or deleted in the future[24]. On the other hand, it must be taken into account that the use of such instrument, enables to avoid any form of abuse and corruption actually diffused in private-public parties’ transactions[25]. The architecture at the base of the blockchain, is able to trace and verify each piece of information uploaded into the blockchain; this information will be further encrypted and transferred in a digital public ledger, that will be absolutely unalterable. Consequently, if we extend the use of blockchains – for example – to the citizen-public authority relation[26], we can see as the blockchains become a valid tool to avoid any contamination of the relations like corruption. In conclusion, the transparency of all the information available on the blockchain, together with the absolute impossibility of tamper with data, would makes the procedures of public administration (fundraising, public projects etc.) secure, so that nobody would altered it for personal or third partied interest[27].

4. From the beginning of its creation in 2009, the interest for bitcoins has increasingly grown, making the evaluation of all the possible consequences of its competition with the legal currency an absolute priority.

Recent studies demonstrate that the bitcoin is not in the position to exercise the regular monetary functions and that cannot be a valid substitute to the regular currencies[28]. In particular, it emerges that bitcoins are not able to fulfil none of the typical monetary functions (medium of exchange, store of value, unit of account). Furthermore, the spread of the phenomenon has reach a level such as to pose a threat for a “speculation bubble that may be a toxic concept for the investors”, as the famous economist Stephen Roach[29] has pointed out. It follows that the bitcoin can easily be out of control that might undermine the fragile economic equilibrium.

On top of that, it must be taken into account also the potential abuses of bitcoins, related to the money laundering, terrorism-financing and new potentially dangerous functionalities inherent in the new technology. It is crucial at this point that the institutions start to work in order to fill the gap in the regulation, gap that may constitute an uncertain scenario in the context of financial system. And in addition, virtual currencies could represent a threat for the financial markets that might undermine the stability, in case the high volatility that characterize bitcoins could affect the dependence from the system. For example, the introduction of the futures on bitcoins at the Chicago Stock Exchange[30] may represent the first admission of the cryptocurrency in the financial market, by adversely affecting the operations. The abovementioned phenomenon may represent also a destabilising factor for the transactions, distorting the normal operation and the normal function attributed to the currency (economic and political stability).

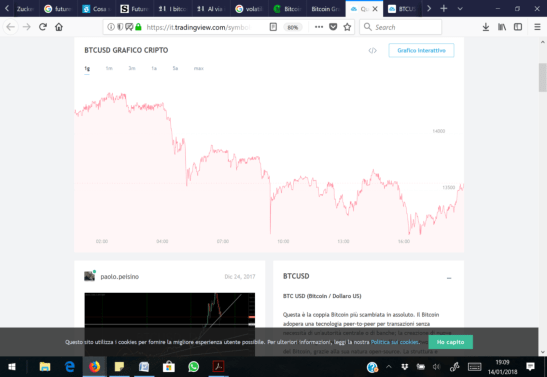

On the light of that, the bitcoin phenomenon is at the bottom of a high speculative market, connected – as the graph below shows – to its high characteristic volatility.

GRAPH: http://www.tradingview.com

The graph shows high fluctuations in a short interval, due to the high uncertainty of the bitcoins value, that may constitute a fertile ground for speculation behaviours.

That said, it is crucial as in the face of a growing interest in bitcoins, the predisposition of an adequate control mechanism, still missing, is assuming a more and more importance; and in such a critical context, this lack treats the potential traders in this new segment. The awareness of the effective consistency and diffusion of the phenomenon should encourage the authorities in taking actions against the potential risks, especially for those inexperienced operators that are not able to identify and evaluate them, attracted by the promise of high profits with low investments[31].

These measures should be able to increase the level of protection for the investors that, as can be seen from the European law (see also the MiFID II)[32], are at the center of attention of the legislator[33]. Nowadays the only way to have a legal regulation for the bitcoins ecosystem is to refer to the soft law context, both in a domestic and European level. In particular, the EBA emphasize the risks related to the use of bitcoins, encouraging the need for a stronger regulation; Bank of Italy, at a domestic level, and according to the guidelines provided by EBA, released in January 2015 an official warning against the potential risks, specifying also that the enumeration of the possible cases in issue may be not exhaustive and that might be further and unknown threats[34]. It is clear that the Authorities, even if they acknowledge the regularity of the cryptocurrency transactions (they are not illegal per se), solicit – by using intervention mechanism under the moral suasion[35] context – a careful use of the instruments, whose legal identity is still undefined and not ready to guarantee a proper protection and to avoid the potential negative effects on the financial system[36].

The sense of the riskiness of the virtual currency leads the Russian Federation to take the necessary steps to prevent the risk: the Russian government has officially published a draft federal law which regulates cryptocurrencies through establishing that operators of the exchange of digital financial assets can only be legal entities, in a similar way as SPV does for credit sensitive derivative instruments[37].

In conclusion, since cryptocurrencies are at the moment out of the legal protection, it is impossible for the operator that does not succeed in closing a transaction in bitcoin to appeal to the authority.

5. One of the most critical aspect in subiecta materia is the fiscal treatment of those bitcoin operations with particular regard to money laundering and terrorism financing. To follow up the first aspect, we must clarify that the authorities have highlight the necessity of a different taxation for the cryptocurrency operations according to the objective they are used for; in other words, it can be for speculation purposes or for transactions purpose. That doesn’t mean, as it happens most, that the two purposes can co-exist; we mean that an operator can use bitcoins to buy a product or a service and then the bitcoins can be used in trading operations in a financial market[38].

The first attempt for a legal regulation is attributed to the resolution 72/E/2016 of the Tax Agency, that aim to disentangle the issue of the fiscal treatment for the companies that provide services for bitcoin trading. In that resolution, the Revenue Agency replies to a tax clearance application of a company that asks the correct fiscal treatment of IVA and the companies’ income tax (IRAP and IRES) of cryptocurrency transactions. The response of the Revenue Agency is based on the judgment of the European Court of Justice C-264/14, 22nd of October 2015.

With regard to the IVA, we need to consider the three prerequisites imposed by d.p.r. 633/1972 (objective, subjective, spatial)[39]. According to the law, is not possible to impose this tax; there are in fact all the condition for considering the bitcoin transaction as a IVA[40] exemption and so they are treated – for fiscal purpose – as any other legal currencies.

According to the company taxation system, the taxation is calculated on the net revenues of the trading company for the intermediary service. These revenues are recorded in the balance sheet at the financial year in question as any other asset subject to IRES and IRAP taxation.

And at the end of the financial year in question – during the Balance Sheet drafting – if the company has still bitcoin in its assets – in accordance with the international accounting standards – they will be measured at the fair value[41], considering the quotation of the currency at 31/12.

If the trade of virtual currency would be done not by a legal entity – as we have previous analysed – but by an individual, the taxation will be applied if there are speculative purposes. The bitcoins possessed for spot transactions won’t be considered a taxable income as any other legal currency. But on the other hand, if the bitcoins are held for speculative purposes, the revenues from the bitcoin trading will be considered as the foreign currency asset. It follows that to give a legal definition of the purpose of the cryptocurrency we refer to the economic relevance principle, defined in the amount of 51.645,69 euro for at least seven consecutive days[42]. Consequently, only in the face of a longer possession of a higher amount in bitcoin the assets will be considered as for speculative purposes[43].

Therefore, the virtual currency is considered in the same way as foreign currency to simplify the process of how handle bitcoin operations. The fair taxation of the profits from the bitcoins speculation should be assimilated to the taxation imposed to other income[44], since bitcoin is not a real currency[45]. The best way to unravel the puzzle is on a case by cases basis, either for a legal entity, or for individual.

From the bank and financial perspective, the identity of bitcoins and any other virtual currency is clear: they are assimilated as any other foreign currency, both for simplification and for different purposes from the financial market regulation, where the investor protection theme is crucial and does not allow any simplification.

And on the light of that, we must point out that the virtual currency are potential candidates to foster phenomena like money laundering and terrorist financing[46]. If on one hand the anonymity that characterizes the bitcoin operations is likely to be used for criminal purposes, on the other hand the information, – embedded in the blockchain – are more trackable than the liquidity is. And indeed, the latter is unquestionably less transparent. What it mostly concerns the Supervisory Authorities is the anonymity that characterize the operations conducted in the blockchain; the operators or the “node” that operates in the blockchain with these currencies – under a pseudonym – cannot be identified as for other activities under legal supervision[47]. And this anonymity makes impossible to find the author of the operation and if necessary to adopt the appropriate anti-money laundering measures.

Clearly, it is a matter of absolute importance to trace and map the clientele that operates in bitcoins, and the great “dilemma” is represented by comprehending in which phase of the process the security systems should be. Essentially, the critical point is not the utilization of the virtual currency to buy a product or a service, but it is the moment when the virtual currency gets in touch with the real world and the virtual currency is converted into legal currency and vice versa (Exchange). That is why in that moment is possible to place money resulting from illegal activities in the blockchain and ten converting them in legal currency, contaminating in this way the system; in fact the anonymity is lost at the exact moment of the conversion of bitcoins into legal currency or vice versa (because to convert bitcoins into legal currency it is required to resort to an Exchange platform).

And to conclude, it must be pointed out that the MEF has recently proposed a draft decree, that requires that any entity that wants to offer any service through cryptocurrencies, is required to register in a special registry established at the OAM (Organismo degli Agenti e dei Mediatori)[48]. It seems to be the first attempt to build a preliminary regulation for those that operates in virtual currency, both for the safeguard of the investors and for the safeguard of the economic system.

6. In conclusion, we can say that the technological evolution and the digital evolution, even though their complexity, must be accepted and elicited.

As it has been assessed in the present study, the growing phenomenon of crypto currencies – in addition to introduce potential danger (with evident damages for those who use them improperly) – emphasizes the need to move forward new forms of regulation of such complex matter, so that it can be redefined under the competence of the public authority.

The questions arose, even if they identify the boundaries of the current legislation in subiecta materia, must not represent the source of abandonment of principles of market stability and security for investors; as we know, they are result of years and years of researches under strain for a long time. Embracing the modernity does not mean accepting the disorder without adequate, preventive investigations, in order to take into account of the possible patterns of implication that it can generate. The legislator is required to adequate the legal system to the occurring changes that, if not properly defined under a proper regulation system, can have serious negative impact on the social and economic equilibrium of the country. It is also a matter of scholars to elicit such normative process through developing analysis and researches that, highlighting uncertainties and critical issues in the above-mentioned legal-economic matter, may provide support to make coherent choices with the tradition of our countries.

It comes to mind the famous quote of Einstein: “I fear the day that technology will surpass our human interaction”.

[1] See Capriglione, Moneta, Enc. dir., Milan, 1999, 747 ff.; Marzona, La funzione monetaria, Padua, 1993; Randall Wray, From the State Theory of Money to Modern Money Theory: An Alternative to Economic Orthodoxy, working paper No.792, March 2014, available at http://www.levyinstitute.org/pubs/wp_792.pdf.; Drèze, Money and uncertainty: inflation, interest, indexation, 1993, Rome, Banca d’Italia, Paolo Baffi Lectures on Money and Finance, available at https://www.bancaditalia.it/pubblicazioni/lezioni-baffi/pblecture- 02/2__Vol__2_Moneta_Incertezza_Inflazione_Interesse_Indicizzazione_BIS.pdf?language_id=1

[2] For a large review of those arguments that have been proposed in the literature see, among others, Ascarelli, La moneta, Padua, 1928; Keynes, A Treatise on Money, London, Macmillan, 1930, I, chapter 1; Savona, La sovranità monetaria, Rome, 1974; Stammati, Moneta, Enc. Dir., vol. XXVI, Milan, 1976; Kelsen, Il problema della sovranità e la teoria del diritto internazionale, Milan, 1989.

[3] See, among the others, Lemme, Peluso, Criptomenta e distacco dalla moneta legale: il caso Bitcoin, Riv. Trim. Dir. Econ., 2017, 148 ff.; Velde, Bitcoin: a primer, Chicago Fed Letters No. 317, The Federal Reserve Bank of Chicago, 2013; Hanley, The False Premises and Promises of Bitcoin, Cornell University Library, 2013; contra: Plassaras, Regulating Digital Currencies: Bringing Bitcoin within the Reach of the IMF, Chicago Journal of International Law, 14(1), 2013, p. 377 ff.; Folkinshteyn, Lennon and Reilly, The Bitcoin Mirage: An Oasis of Financial Remittance, Journal of Strategic and International Studies 10, 2015, 118 ff.

[4] See infra Par. 5

[5] On this point see Banca d’Italia, Avvertenza sull’utilizzo delle cosiddette «valute virtuali», Rome, 30 January 2015, 1 ff.; Scalcione, Gli interventi delle autorità di vigilanza in materia di schemi di monete virtuali, Analisi giuridica dell’economia, 1/2015, 139 ff.; Padovan, Esma-Eba-Eiopa: risparmio a rischio con le valute virtuali, http://www.bancaforte.it/notizie/2018/02, 13th of February 2018. See the Esa’s document on cryptocurrency at the site http://www.consob.it/web/consob/novita/-/asset_publisher/xMXdfdeSuZFj/content/articolo-sole-7-feb-20-1/11981.

[6] About soft law see Giovanoli, International financial standards as «soft law», International Monetary law, edited by Giovanoli, Oxford, luglio 2000; Lemma, Soft law e regolazione finanziaria, Nuova giur. civ. comm., 2006, 11, 600 ff.; Norton, «Qualified Self-Regulation» in the New International Financial Architecture, in The Journal of International Banking Regulation, July 2000, 9.

[7] Mancini, Valute virtuali e “Bitcoin”, Analisi giuridica dell’economia, 2015, 117; Mersch, Digital Base Money: an assessment from the ECB’s perspective, Helsinki, 16 January 2017.

[8] “ The history of Bitcoin shows that this exchange rate of a virtual currency can be highly volatile …”, see ECB, Virtual currency schemes – a further analysys, February 2015, https://www.ecb.europa.eu/pub/pdf/other/virtualcurrencyschemesen.pdf, p. 23.

[9] See European Central Bank, Virtual currency schemes – a further analysys, cit.; in particular, ECB explains that “In the EU, virtual currency is not currently regulated and cannot be regarded as being subject to the (current) PSD or the EMD. As the phenomenon is still relatively new and also moving into different areas, it would be too early to try making new, tailor-made legislation” (p. 24).

[10] Allow me to recall Pellegrini, Banca Centrale Nazionale e Unione Monetaria Europea. Il caso italiano, Bari, Italy, 2003, chapter 1.

[11] See Gasparri G., Timidi tentativi giuridici di messa a fuoco del bitcoin: miraggio monetario crittoanarchico o soluzione tecnologica in cerca di un problema? Il diritto dell’informazione e dell’informatica, 2015, 3, p. 418.

[12] On this point see Gasparri, cit., p 419.

[13] About global financial crisis see Capriglione, Crisi a confronto (1929 e 2009): il caso italiano, Padua, 2009; Financial Regulation: A post crisis analysis, ed. Wymeersch, Hopt, Ferrarini, Oxford University Press, 2012; Cassidy, How markets fail : the logic of economic calamities, New York, Straus and Giraux, 2009; Bernanke, Essays on the Great Depression, 2009; Micossi, Bruzzone, Carmassi, The new European Framework for managing Banking Crisis, Centre for European Policy Studies, Policy Brief, No. 304, 21 November 2013, 1 ff.; Visco, The aftermath of the crisis: Regulation, supervision and the role of central banks, Lecture delivered at Harvard Kennedy School, Cambridge MA, 16 October 2013.

[14] Dowd, New Private Monies. A bit-part player? IEA, The institute of economic affairs, 2014, 38, available at https://iea.org.uk/wp-content/uploads/2016/07/New%20Private%20Monies%20-%20Kevin%20Dowd.pdf.; Cuccuru, “Blockchain” ed automazione contrattuale. Riflessioni sugli “smart contract”, Nuova giur. Civ. Comm., 2017, II, p. 107.

[15] On this point see ECB, Opinion of the European Central Bank of 12 October 2016 on a proposal for a directive of the European Parliament and of the Council amending Directive (EU) 2015/849 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing and amending Directive 2009/101/EC (CON/2016/49), https://www.ecb.europa.eu/ecb/legal/pdf/en_con_2016_49_f_sign.pdf.

[16] See Hoegner, What is bitcoin?, The law of Bitcoin, by Jerry Brito Et Al., Bloomington, 2015; Financial Action Task Forse – FATF, Virtual currencies. Key definitions and potential AML/CFT risks, June, 2014, 4.

[17] For a complete analysis of the legal nature of bitcoins see: The law of Bitcoin, by Jerry Brito Et Al., cit.; Capaccioli, Criptovalute e bitcoin. Un’analisi giuridica; Mancini, Valute virtuali e bitcoin, cit., 117 ff.; Bocchini, Lo sviluppo della moneta virtuale: primi tentativi di inquadramento e disciplina tra prospettive economiche e giuridiche, Dir. dell’informazione e dell’informatica, 2017, 1, 27 ff.; Vardi, “Criptovalute” e dintorni: alcune considerazioni sulla natura giuridica dei bitcoin, Diritto dell’informazione e dell’informatica, 2015, 3, 443 ff.

[18] Another interesting aspect is the so-called “mining” of the virtual currency, namely the act of creating valid Bitcoin blocks which requires demonstrating proof of work. Miners are devices that mine or people who own those devices (sources http://www.bitcoin.org, http://www.ilpost.it).

[19] “Whoever refuse to receive legal coins can be punished with legal punishment”.

[20] Even if “Internet giants” like Facebook and Amazon started to accept bitcoins as payment, it is not sufficient to accept bitcoins as alternative legal tender (source “Amazon prossima a introdurre i Bitcoin come mezzo di pagamento?”, published on http://www.lastampa.it; Soldavini, “Zuckerberg studia le criptovalute: Facebook pensa a un suo bitcoin?”, published on IlSole24ore.it.

[21] The literature labels “shadow money” situations characterized by the absence of regulation in the field of virtual money, distinguished by opacity and operational riskiness. A call for public intervention to control the monetary effects of this phenomenon is rather desired.

See Pozsar, Shadow Banking: The Money View, july 2, 2014, available at https://www.financialresearch.gov/working-papers/files/OFRwp2014-04_Pozsar_ShadowBankingTheMoneyView.pdf; Pozsar, A Macro View of Shadow Banking, 2015, https://ftalphaville-cdn.ft.com/wp-content/uploads/2015/07/Pozsar-A-Macro-View-of-Shadow-Banking-Levered-Betas-and-Wholesale-Funding-in-the-Context-of-Secular-Stagnation.pdf; Ricks, Regulating money creation after the crisis. Harv. Bus. L. Rev., 2011, 1, 75; Gabor and Vestergaard, Towards a theory of shadow money, 14 april 2016, 1 ff.

[22] There is no doubt that they have been created to cut the transaction costs, but they can easily turn into a speculation, thanks to the high risks (often associated to high yields)

[23] It must be taken into account that the novelty of the phenomenon is no into the cryptocurrency per sé, but relies on the technology behind it, the blockchain. There is a growing number of retailers accepting virtual currency, such as Apple, Reddit, Expedia or WordPress. The bitcoin phenomenon is the first implementation of that technology, but the two terms must not be overlapped. A blockchain is a continuously growing list of records, called blocks, which are linked and secured using cryptography.

[24] Each node has data about all the confirmed transactions, so each node works as an archive of previous transactions that cannot be altered, otherwise all the subsequent transactions will be deleted.

[25] Source: http://www.blockchain4innovation.it

[26] Similar role of SPID (Sistema Pubblico di Identità Digitale), an online platform that manage the relations between public authorities and citizens.

[27] Cf. Prosser, Così la tecnologia blockchain può ridurre la corruzione, published on formiche.egomnia.com. It should be recalled, however, the economist Nouriel Roubini, who claims that blockchain is not more efficient of the existing database and that it won’t replace the financial intermediaries. See also Caparello, Roubini: “Blockchain tra le teconologie più sopravvalutate di sempre”, available at wallstreetitalia.com., 6 March 2018.

[28] There are many studies supporting this statement, including the BCE’s – supported by Bank of Italy – that says that bitcoin, due to the low degree of acceptance as payment method, and to the low purchasing power (resulting from the high volatility), is actually not a currency.

[29] The economist Stephen Roach, in an interview with CNBC, he highlighted the multiple negative aspects bitcoin, in particular regarding the high fluctuation of the currency “by any shadow or stretch of the imagination” as he defined.

[30] Cf. Soldavini, I bitcoin volano al debutto dei futures. Allo studio due ETF, IlSole24Ore, 11.12.2017.

[31] Actually, the reality shows the ignorance and irrationality of the average operator: many operators make their decision according to their prejudice or their emotions, without knowing, in many documented cases, neither the mechanism of the instrument nor the risk.

[32] Directive 2014/65/EU and Regulation EU No 600/2014 which impose stricter rules to the less experienced market operators. Cf. Pellegrini, Serrano and Motroni, in La Mifid II, by Troiano and Motroni, Padua, 2016. The Directive 2014/65/UE has been transposed with d.lgs., 03.08.2017, n. 129; with Delibera 16.02.2018, n. 20307 Consob approved the Communication for investor Protection to incorporate the Directive 2014/65/EU and Regulation No 600/2014.

[33] It follows that the major concern of such instrument is the fact that it is out of the control of the Supervisory Authorities. The applicability of the rules for those who consult the accredited intermediaries, that can verify the consistency of the investments and the personal needs, investment purposes, the expertise of the single investor is lost; and the latter, if he wants to get in touch with the bitcoin reality, he will have to do it by himself.

[34] Circ. BI Avvertenza sull’utilizzo delle cosidddette “Valute Virtuali”, 30.01.2015; Opinion on “virtual currencies” (EBA/Op/2014/08), 04.07.2014.

[35] Cf. Capriglione, Le fonti dell’ordinamento finanziario, in Manuale diritto bancario e finanziario, by Capriglione, Padua, 2015.

[36] it should not surprise that numerous banks are not anymore accepting transactions in bitcoin, also due to the numerous breakdown of the currency in the recent past and that might produce significant loss, altering the sound and prudent management.

[37] Cf. La federazione russa intende regolamentare lo scambio del Bitcoin e delle criptovalute, rainews.it, 16.03.2018.

[38] it should be emphasized a significant feature of cryptocurrencies – that cannot occur in any other stock in a regulated market – the different listing from a platform to another, inducing multiple arbitrage strategies. If the market would be regulated – not the case of the virtual currencies – the mismatch between different platforms would not be possible, and the arbitrage strategies would be discouraged. Cf. Lops, Bitcoin: piattaforma che vai prezzo che trovi, IlSole24Ore, 9 December 2017.

[39] See Guarasci, IVA, presupposti per l’applicazione: soggettivo, oggettivo e territoriale, http://www.informazionefiscale.it.

[40] It must be taken into account that the legal currencies are a mediem of exchange, and this seems to be their only function; there is no example of its use as a commodity and therefore the currency transaction has not imposed IVA (Art. 135.1 lett. e) Directive 2006/112). Virtual currencies are treated as any other currency, apart from the legal tender. Only if the cryptocurrency would be excluded from the other currencies, they could be subject to IVA. Cf. Capaccioli, Regime impositivo delle monete virtuali: poche luci e molte ombre, in “Il fisco” n. 37, 2016.

[41] The fair value is “The price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date” (IFRS 13). Cf. http://www.revisorionline.it. It means that each asset or liability will be reported in the balance sheet at its current market value, avoiding any potential over and underestimation. So, we consider the market price of the bitcoin at 31/12.

[42] See also Zonca, Il regime fiscale delle operazioni in valuta e delle differenze di cambio, Approfondimenti dirittobancario.it, November 2016.

[43] Cf. Come si tassano le rendite da bitcoin e criptovalute? http://www.valutevirtuali.com.

[44] Other income is a residual category, artt.67 ss. TUIR, which contain all the not classifiable incomes (art. 6 TUIR) opposed to capital income.

[45] Cf. Econopoly, “Bitcoin e tasse, domanda: il privato cittadino deve dichiarare le plusvalenze o no?” Il Sole24Ore, 10 September 2016.

[46] Many studies show that the operations in virtual currency enable money laundering activities and terrorist financing; see also Goldman, Marumaya, Rosenberg, Saravalle, Solomon-Strauss, Terrorist use of virtual currencies, CNAS; Foley, Karlsen, Putnins, Sex, drugs and bitcoin: How much illegal activity is financed through cryptocurrencies? SSRN-id3102645, January 2018; Carlisle, Virtual Currencies and Financial Crime, RUSI Occasional Paper, March 2017.

[47] According on the cryptography it will be possible to identify an IP address, if it is not encrypted as well. The proper control represents one of the most important control required by the anti-money laundering legislation to monitoring the recurring operators: it consists in identifying the operator, acquiring information about the nature and purpose of the operation and keeping a constant monitoring of the operations in order to promptly identify any suspicious facts. Cf. Loconte – Ogliaruso, Antiriciclaggio: gli obblighi di adeguata verifica della clientela alla luce della nuova normativa antiriciclggio, Diritto 24, IlSole24Ore, 07.07.2017.

[48] See the draft on http://www.mef.gov.it. Cf Valute virtuali, il Mef vuole un registro: pronto il decreto, http://www.repubblica.it, 2 February 2018.

Authors

Mirella Pellegrini is Full Professor of Economic Law at the Department of Business and Management of LUISS Guido Carli University in Rome. She is member of the Editorial Board of “Law and Economics Yearly Review”, of the Scientific Committee for the Evaluation of “Rivista Trimestrale di Diritto dell’Economia”; of the Editorial Board of the Journal Bankpedia-Assonebb; of the Scientific Committee of the serie “Ricerche giuridiche”, ES (Editoriale Scientifica) editor; of the Scientific Committee of the Association “IGS” (Istituto per il Governo Societario); of the Scientific Committee of the Series “Diritto Pubblico e Diritto dell’Economia” (Giappichelli); of the Scientific Committee of the magazine Banche e Banchieri. She is the author of numerous publications (monographs, essays, articles, commentaries, research papers) on EU and Italian banking and financial regulation, securities regulation, company law.

Francesco Di Perna is a financial consultant in Poste Italiane. Expert in the field of economic law. University assistant in Law and Economics at LUISS in Rome.

Paragraphs 1, 2, 3 and 6 by Mirella Pellegrini; paragraphs 4 and 5 by Francesco Di Perna.

You must be logged in to post a comment.